With the disruption caused by COVID-19, recognising that speed-to-scale will determine success or failure is what has helped FinTechs (Financial Technology Companies) emerge from the pandemic fairly unscathed. In comparison to the 17% of traditional brick-and-mortar banks, only 1% of FinTech companies were critically affected, and 2% severely affected by Coronavirus.

So, what makes them different? It is the commitment to digital innovation, in particular digital ecosystems built on APIs, that has enabled FinTechs and Open Banking solutions to offer market leading customer experiences at scale.

In this blog, we are looking at how Salesforce and MuleSoft can help FinTechs achieve speed-to-scale and speed-to-market without compromising security or quality through the use of reusable APIs.

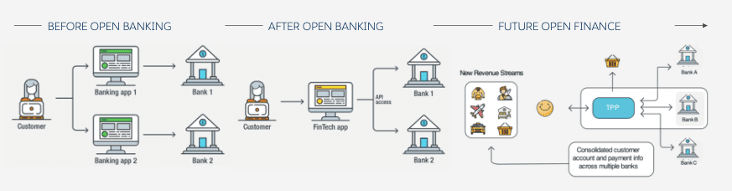

Credit: MuleSoft

Before we answer this question, we should take a step back and look at what we mean when we talk about Open Banking and FinTech. Open Banking is the process, and FinTech is the technology. As the graphic above shows, before Open Banking, customers were given multiple data entry points to access different pieces of their financial data. After Open Banking and the rollout of FinTech applications, customers can now access all of their information in a dashboard view.

This solution has been extremely popular since it’s early adoption in 2017. You have only to look at the current consumer statistics for FinTech and Open Banking in comparison to traditional banking institutions to see this.

For example, 64% of consumers are now using one or more Fintech platforms in 2020, this is up from 33% in 2017. The growth in the market is a clear indication of the shift from traditional banking institutions to FinTech and Open Banking services.

As a leader in FinTech, the UK is a great example of this accelerated adoption. In the past year alone, the number of active customers using the services of UK Fintech has tripled, from just under eight million to nearly 20 million customers. In addition, over one million consumers have signed up for Open Banking and over 200 companies have been approved to share data and deliver more transparency to customers.

On the surface, FinTech is a very straightforward solution to customer demand for high accessibility and personalisation, however there are still some teething problems that need to be addressed. For example, many FinTechs have standardised API-led connectivity within their platforms, but the consent and authorisation of data sharing has not yet been standardised.

This is where data security becomes a real issue. Which is why it’s important to have secure and scalable APIs.

Such APIs must support security measures such as encryption, strong customer authentication, and auditing to keep financial transactions and information secure. They must be scalable and efficient. When payments are invoked through APIs and are revenue generating, poor availability and reliability are not an option.

By using this API-led approach FinTechs are able to promote decentralized access to data and capabilities, while not compromising on governance and security – shifting culture to one of reuse and composability.

Forrester found that MuleSoft customers realise an ROI of 445% within just three years and were able to free up 90% developer time from maintaining APIs and integrations.

Below are some key use cases showcasing how API-led integration is key to FinTech and Open Banking’s quick time-to-scale and time-to-market.

TicToc, an Australian fintech company, launched in July 2017 to transform the traditional home loan process and give Australians more control with a smarter home loan. TicToc focuses on removing inefficiencies in the home loan approval and fulfilment process — enabling customers to abandon paper-based processes and easily submit loan applications online to receive instant decisions on their applications.

| Challenge | Solution | Result |

|---|---|---|

| Integrating data to improve the home loan process. | To automate the home loan process, TicToc used APIs to unlock data from an e-form application as well as 21 other systems. | Reducing the loan application process from 22 days to 22 minutes. |

| For TicToc, delivering with a seamless, instant, home loan application experience required: • Integrating core system data from e-form applications, valuation and verification services, the credit bureau, scorecards, and more • Offering real-time document generation and home loan decisions • Delivering their new product to market quickly to gain a competitive advantage • Solution • Delivering an instant, real-time loan decision |

Using APIs, TicToc drastically reduced the amount of information that customers have to provide and automated previously manual tasks, such as validating the customer’s identification and financial background as well as the property valuation. With TicToc, customers can simply enter the property address, then the TicToc technology integrates that data on the back-end with a property database to instantly calculate the property value via their automated valuation model. The same automation approach was mirrored for other stages of the application process |

As a result of this approach, the company was able to launch an innovative home loan experience, where customers can receive full home loan approval in as little as 22 minutes, compared to the 22-day industry average. Since its launch, TicToc has received home loan applications valued at more than $2.15 billion. |

Other useful links:

Recent webinars on Anypoint Platform

API Recipes with MuleSoft Anypoint Platform

Related reads.

About Coforge.

We are a global digital services and solutions provider, who leverage emerging technologies and deep domain expertise to deliver real-world business impact for our clients. A focus on very select industries, a detailed understanding of the underlying processes of those industries, and partnerships with leading platforms provide us with a distinct perspective. We lead with our product engineering approach and leverage Cloud, Data, Integration, and Automation technologies to transform client businesses into intelligent, high-growth enterprises. Our proprietary platforms power critical business processes across our core verticals. We are located in 23 countries with 30 delivery centers across nine countries.