In the fast-evolving landscape of wealth management, hyper-personalization is emerging as a pivotal strategy to deliver tailored financial services that meet the unique needs and preferences of each client. This approach goes beyond traditional personalization by leveraging advanced data analytics, artificial intelligence (AI), and machine learning to create deeply customized experiences for clients and advisors alike. Even McKinsey studies demonstrate that personalization can improve customer satisfaction by up to 30% and increase revenue by up to 15%.

What is Hyper-Personalization?

Hyper-personalization in wealth management refers to the use of real-time data analytics and AI to deliver personalized financial advice, products, and services to clients based on their individual preferences, behaviors, and life circumstances.

Unlike traditional personalization, which might involve segmenting clients into broad categories based on demographics or account size, hyper-personalization focuses on delivering unique experiences that cater to the specific needs of each client. For instance, according to the PwC HNW Investor Survey 2022, 66% Of HNW investors look for increased personalization in their wealth management relationship.

This approach involves analyzing vast amounts of data, including transaction histories, social media activity, financial goals, life events, and even real-time market conditions, to provide personalized insights and recommendations. The result is a highly tailored experience that resonates with each client on a personal level, leading to stronger relationships and better financial outcomes.

Why It’s Imperative for Wealth Advisors?

The demand for hyper-personalized financial services has been growing steadily as clients become more informed and empowered by technology. Today’s clients expect a level of service that reflects their individual needs and goals. They want to feel understood and valued, not treated as just another account number. This shift in expectations is driven by several factors:

- Changing Client Demographics: As younger, tech-savvy generations such as Millennials and Gen Z start to accumulate wealth, their expectations for personalized digital experiences are influencing the wealth management industry. These clients demand transparency, immediacy, and relevance in their interactions with financial advisors.

- Increased Competition: The rise of Robo-advisors and fintech companies has intensified competition in the wealth management space. These digital-first platforms often provide low-cost, automated financial advice that is personalized at scale, forcing traditional wealth managers to up their game.

- Complex Client Needs: Wealth management clients today have increasingly complex financial needs, ranging from estate planning and tax optimization to retirement strategies and ESG investing. A one-size-fits-all approach no longer suffices.

- Regulatory Pressures: Financial regulations continue to evolve, requiring wealth managers to provide more detailed and transparent advice. Personalization helps advisors meet these regulatory demands by ensuring that recommendations are suitable for each client’s specific circumstances.

Clients’ Hyper-Personalized Journey

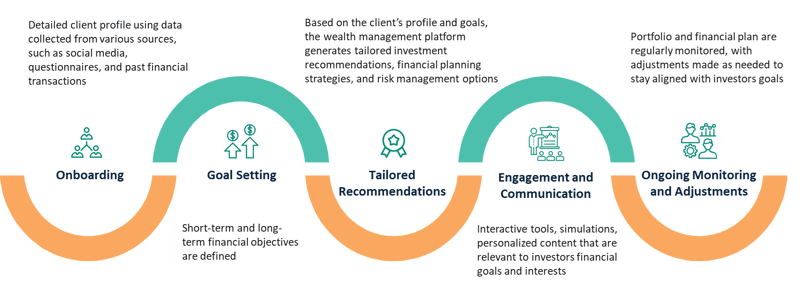

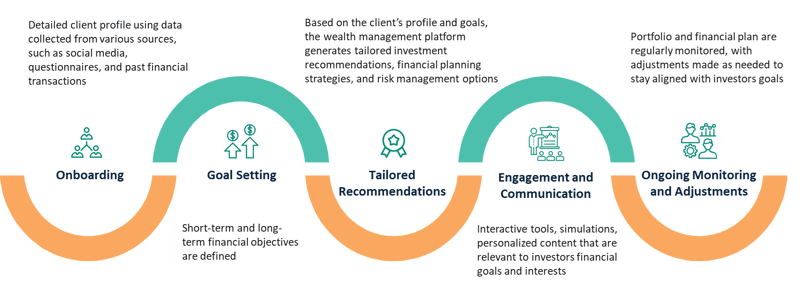

Hyper-personalization transforms the client journey into a dynamic and interactive experience. Here’s what a personalized journey might look like for clients:

What’s in it for the Wealth Advisors?

Hyper-personalization empowers advisors by providing them with the tools and insights needed to deliver superior service and build stronger client relationships.

- Deeper Client Understanding: By analyzing a wide range of data points, advisors gain a comprehensive understanding of each client’s financial needs, preferences, and life circumstances. This enables them to offer advice that is not only relevant but also timely and actionable.

- Proactive Engagement: With hyper-personalization, advisors can engage with clients proactively rather than reactively. For example, if a client’s investment portfolio is underperforming, the platform can alert the advisor, who can then reach out to the client with a solution before the client even becomes aware of the issue.

- Scalability: Hyper-personalization allows advisors to scale their services without compromising on quality. Advanced algorithms and AI tools handle the ‘heavy lifting’, allowing advisors to provide personalized service to a larger number of clients.

- Increased Client Satisfaction: When clients receive personalized advice that directly addresses their needs and goals, their satisfaction levels increase. Satisfied clients are more likely to remain loyal, refer others, and expand their relationship with the wealth management firm.

Coforge’s Hyper-Personalization Solution

Building a successful personalization solution requires a strategic approach that integrates cutting-edge technology with a deep understanding of client needs. Here’s how we approach the development of our hyper-personalization platform:

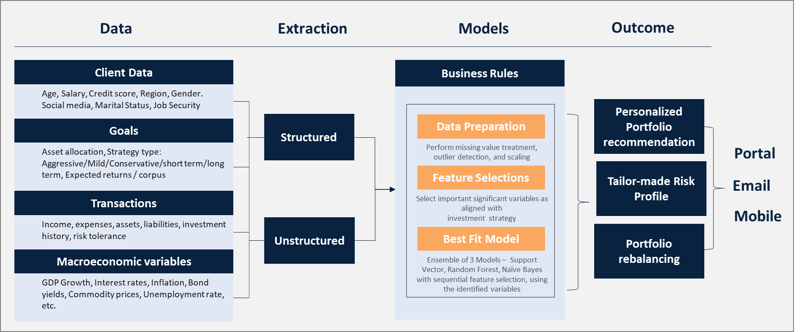

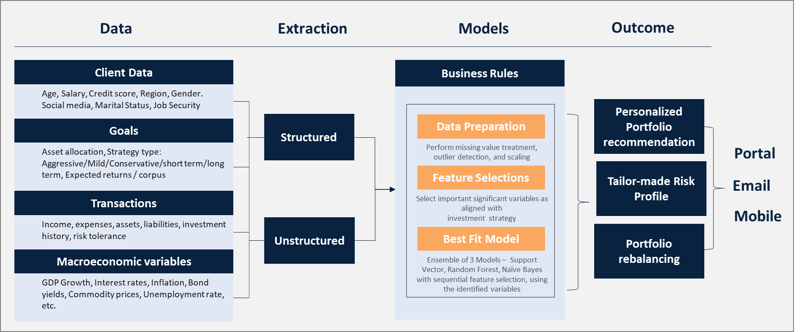

- Data Integration: We start by integrating data from multiple sources.

- Advanced Analytics: Coforge leverages advanced analytics and machine learning algorithms to process the data and generate actionable insights. These insights drive personalized recommendations and strategies that are tailored to each client’s unique situation.

- User-Centric Design: User-centric design that ensures both client and advisors find the platform intuitive and easy to use. This includes customizable dashboards, interactive tools, and seamless communication channels.

Conclusion

Hyper-personalization is revolutionizing the wealth management industry by delivering highly tailored financial services that meet the unique needs of each client. As clients demand more personalized experiences, wealth managers must embrace this approach to stay competitive and relevant. By empowering advisors with deep insights and scalable tools, hyper-personalization enhances client satisfaction, loyalty, and financial outcomes. Coforge’s approach to building a hype-personalization platform is grounded in cutting-edge technology, user-centric design, and a commitment to continuous improvement, ensuring that we remain at the forefront of this transformative trend.

Connect with us to know more: CoforgeBPS@coforge.com