In the bustling world of banking, efficiency is everything. As financial institutions grapple with the challenges of modern markets, many have turned to Robotic Process Automation (RPA) as a quick fix—a band-aid solution to their growing pains. But is RPA truly the answer to the complex problems facing banks today, or is it just a temporary patch on a much bigger issue?

This blog explores how banks can move beyond RPA as a temporary fix, identifying the steps needed to create a future-ready process landscape.

The Quick-Fix Temptation: Why RPA Appeals as a Temporary Solution

Imagine you're at the helm of a mid-sized bank, faced with the daunting task of managing outdated legacy systems, rising operational costs, and the ever-present pressure to enhance customer experience. While RPA can indeed offer short-term relief, it often fails to address the underlying issues that plague banking operations.

A recent study by Publicis Sapient shows that 30% bankers ranked operational agility as their no. 1 barrier to transformation. Hence, finding the root cause and curing from bottoms-up has become a necessity to ensure sustainable growth.

To fully realize the benefits of RPA and AI, banks must aim for a future state where processes are designed to be inherently flexible and scalable. This involves rethinking the entire process flow, eliminating redundancies, and creating a foundation that supports seamless integration of RPA and AI technologies.

RPA Implementation: A Failed Story

Research by EY indicates that although up to 30 to 50% of initial RPA projects fail, RPA has the potential to revolutionize the economics and service level of present manual operations. There have been numerous successful deployments, thus this is not a reflection of the technology itself.

While RPA can automate specific tasks, it does not inherently fix broken processes. One common issue arises when RPA is applied to processes that have not been re-engineered or optimized for automation. For instance, if a bank uses RPA to automate a loan approval process that involves redundant steps or manual data entry, the automation may work in the short term but will ultimately be limited by the inefficiencies baked into the process.

This can lead to a situation where the RPA implementation fails to deliver the expected results, with bots unable to handle exceptions, high error rates, and increased maintenance costs. Such outcomes underscore the importance of not just automating existing processes but also ensuring that these processes are fit for automation in the first place.

Before implementing RPA, it's essential to first address the root issues, as many banks struggle with inefficiencies that RPA alone can't fix. These issues often include:

- Process Silos: Isolated operations that create bottlenecks and require manual workarounds.

- Legacy Systems: Outdated technology that's hard to integrate, leading to high maintenance costs.

- Inconsistent Data Handling: Unstandardized, error-prone data that weakens automation effectiveness.

- Compliance Headaches: Inconsistently applied regulations that risk financial and reputational damage.

Process Assessment – A step in the right direction

To avoid the pitfalls of using RPA as a band-aid, banks need to take a more strategic approach that begins with a thorough assessment of their existing processes. A typical process assessment is necessary to identify the gaps within:

- Workflow architecture, that are driving inefficiencies

- Operating Model, that are leading to increased cost, low CSAT, and reputational, compliance, & financial risks

- Technology architecture, that is impacting the adoption of RPA and AI

However Manual process assessments are time-consuming and require significant effort, involving extensive documentation reviews, stakeholder interviews, and workflow mapping. These tasks demand substantial human resources, with teams sifting through large amounts of data to identify inefficiencies.

The manual approach also increases the risk of missing critical issues and is often slowed by fragmented information gathering from various sources. This can delay necessary improvements and tie up resources that could be used more effectively elsewhere. The high effort involved can lead to fatigue and errors, impacting the quality and accuracy of the assessment.

Cut Down Your Assessment Time with our Tech-led Assessment

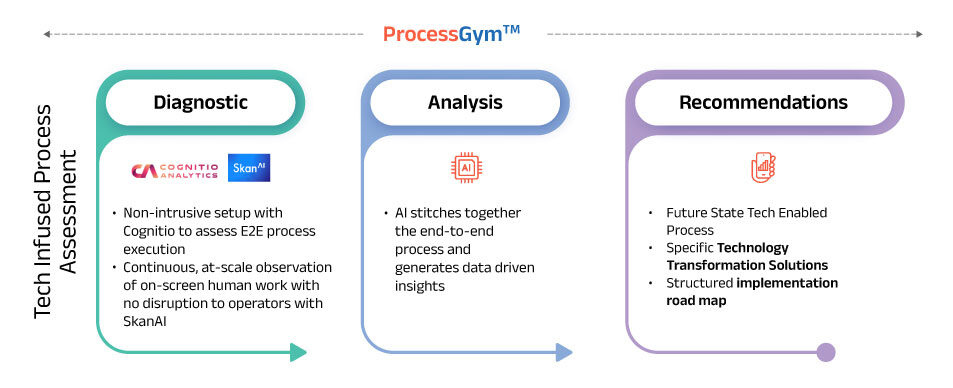

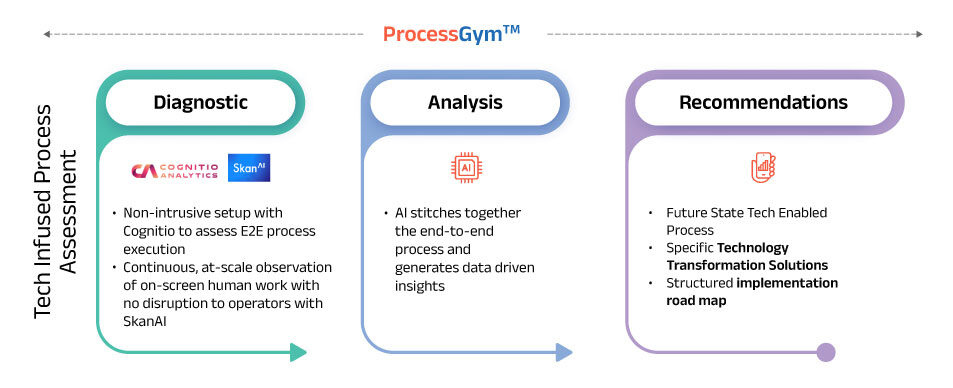

With Coforge’s proprietary framework ProcessGym along with industry leading tools Celonis and SkanAI, get a true picture of your current processes with data-backed insights to build you RPA strategy.

A typical process assessment has the following workflow

A typical process assessment has the following workflow

versus

a Coforge Tech-led Assessment

Our domain experts & six-sigma practitioners will partner with you in every step of your RPA journey to redesign your processes to extract significant gains in process efficiency, reduce operation costs and drive customer satisfaction.

Conclusion

While RPA offers an attractive quick fix for banks looking to automate processes and reduce costs, relying on it as a band-aid solution can lead to suboptimal outcomes. To fully realize the benefits of RPA, banks must first re-engineer their processes, ensuring they are optimized for automation. Furthermore, by integrating AI into their automation strategies, banks can move beyond simple task automation to create intelligent systems that drive long-term efficiency and innovation. The key lies in using RPA not just as a quick fix but as a strategic tool in a broader process improvement and digital transformation initiative.

Click Here to get your FREE Assessment where our team would propose valid POCs to choose from and start transformation.