Traditionally, appraising high-value properties for insurance is slow, expensive, and prone to inconsistency. This blog explores how AI and Machine Learning can transform the process, leading to faster underwriting, reduced costs, and improved accuracy.

Manually appraising high-value properties is a significant bottleneck for insurers. Sending appraisers is costly and time-consuming, while manual valuations can be inconsistent and incomplete. These inefficiencies lead to longer wait times for customers, potential underwriting losses, and overall frustration.

This blog introduces a cognitive solution powered by AI and Machine Learning. It uses image-based data analytics to automate property inspections and appraisals. This innovative approach leverages data patterns and self-learning algorithms to improve accuracy and efficiency over time.

GOAL

Assessing the value of a property right before underwriting is critical and time-consuming especially in High-Net-Worth cases. The process is riddled with inherent challenges as it is expensive to send an appraiser to every property and a manual appraisal is slow and incomplete while the appraisal results vary widely. There is hence a high likelihood that the current method of appraising properties for underwriting is inconsistent and not cost-effective. All this eventually results in longer time to convert a prospect into new business, potential underwriting losses and unhappy customers. Our intelligent solution powered by AI greatly improves inspection and appraisal accuracy and greatly enhances the underwriting decision-making capability.

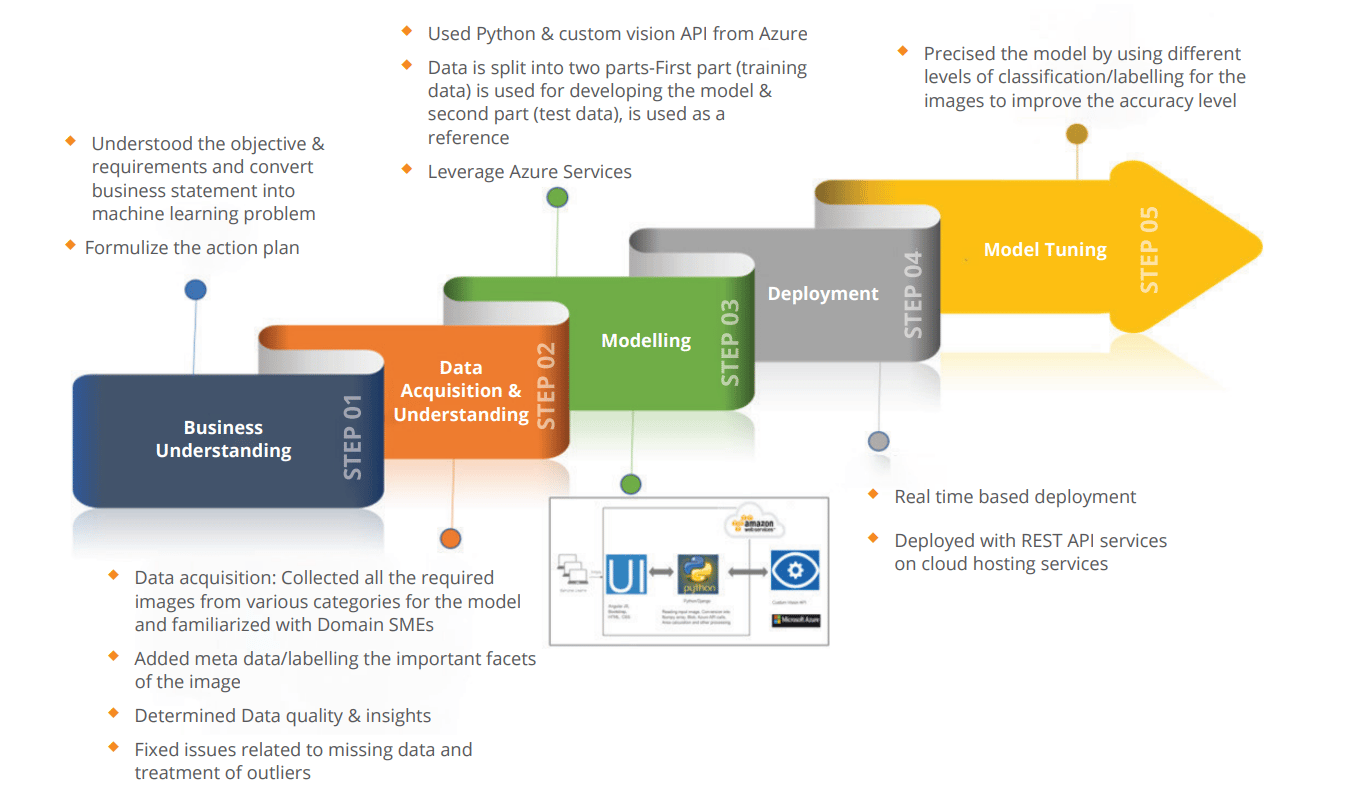

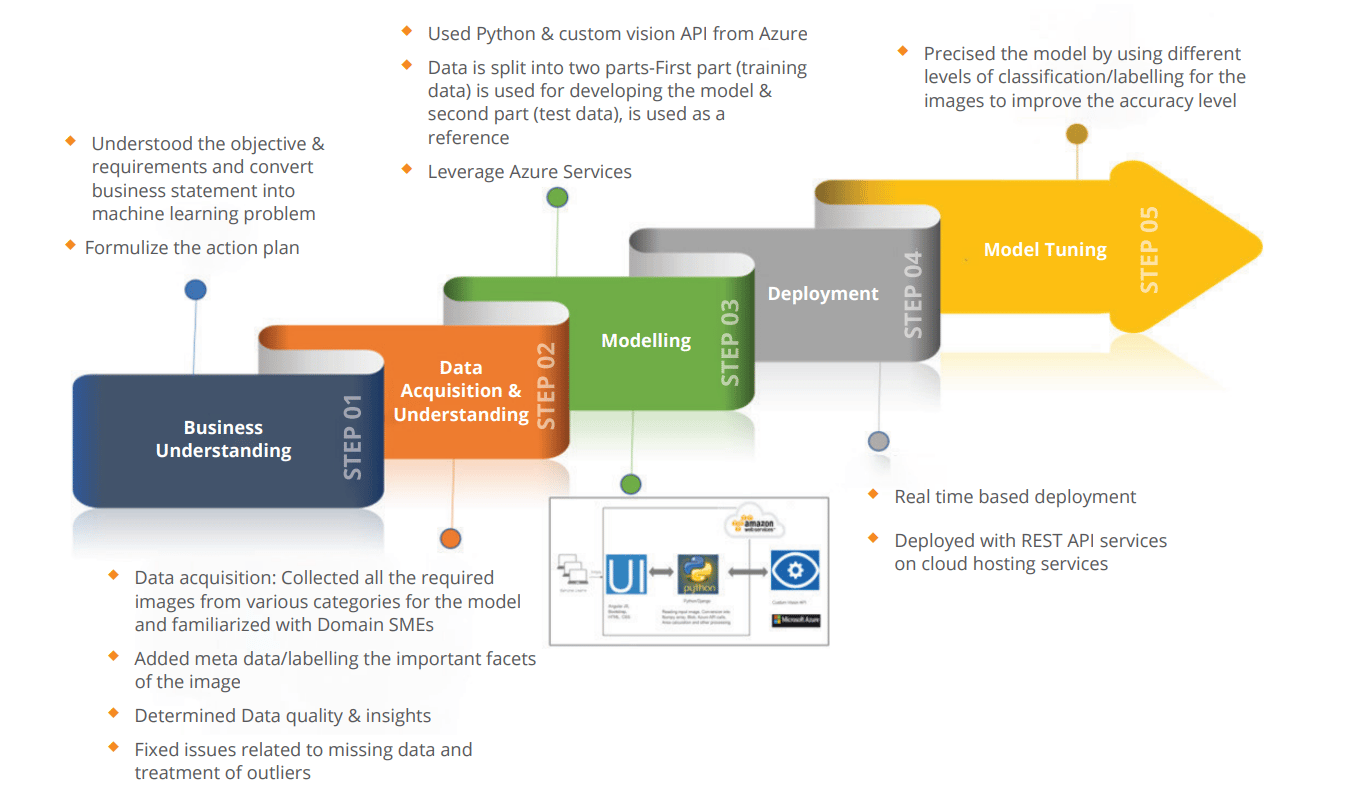

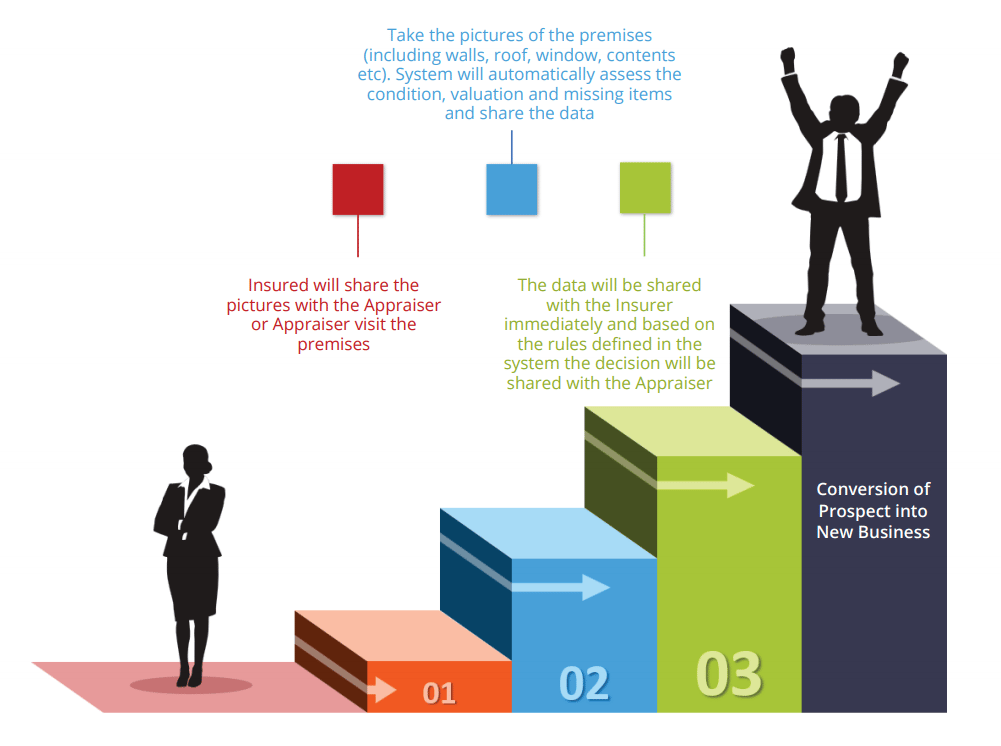

The proposed cognitive solution uses image-based data analytics along with machine learning to study data to study data patterns and determine their validity and authenticity. It then applies image-based data analytics to automate property inspection and appraisal. By leveraging outcome-based prediction, it augments the inspection and appraisal capability of appraisers and improves overall underwriting decision-making. Using the self-learning methodology the data provided to the system will continue to improve the repository of knowledge to study the patterns, process them with machine learning algorithms and provide outcomes with improved accuracy and efficiency during risk appraisal. The solution is divided into 5 stages, right from the time the data is collected until the final go/no-go.

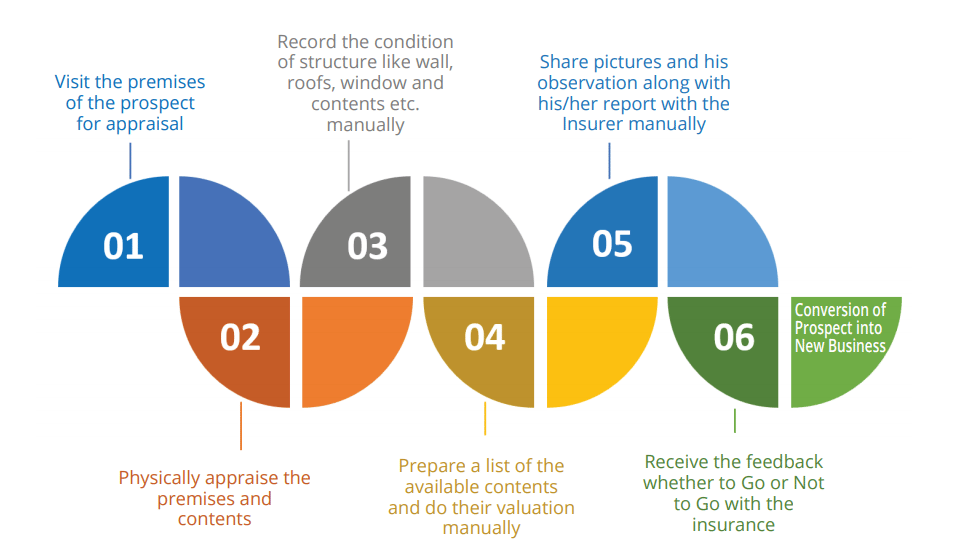

AS-is Process

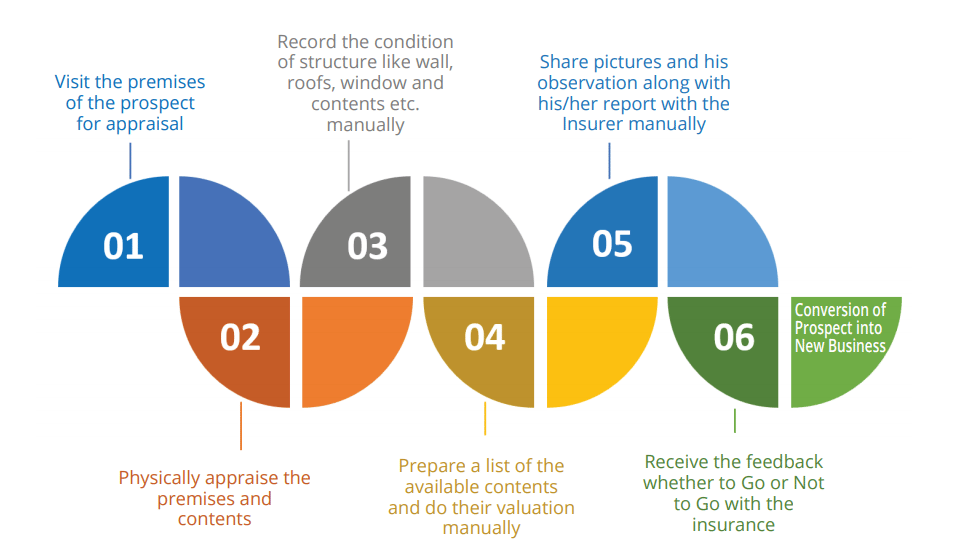

A typical property inspection and appraisal process begins when a prospect approaches the Agent for a quote. To underwrite the risk, the agent/risk appraisers run through a detailed checklist of property inspection (structures, contents, appliances etc.) and appraise each item manually.

This equates to ~ USD 150 operational cost for each inspection (USD 100 million total cost in a year) and longer time-to-market. Additionally, manual intervention is fraud-prone and that is a challenge for insurance carriers.

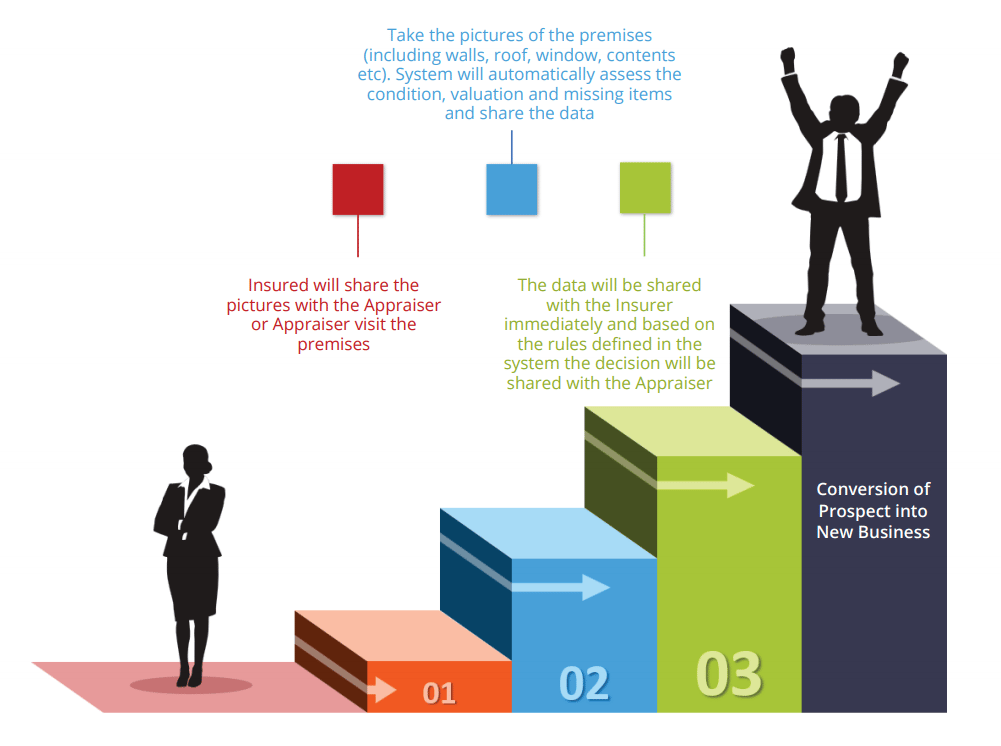

To-Be Process

Our cognitive intelligent solution shrinks the overall underwriting process with higher accuracy, drastic reduction of manual effort and improved time-to-market.

Technologies

- Knowledge repository of relevant images

- Angular, Bootstrap, HTML, CSS

- Custom Vision API and algorithm to leverage Azure services

- Image analysis, Conversion into Numpy array, Blob, Azure API calls, Area calculation etc.

SUCCESS

- Expedite underwriting decision time by 30 - 45 % using cognitive elements like AI & ML along with predictive analytics.

- Reduction in fraud cases by 40 - 50% due to less manual intervention.

- Increase savings owing to reduced physical inspection and manual practice. This includes hiring, training, commutation cost etc. of field adjusters.

- Superior Experience- Reduced customer churn and higher loyalty.

- Unprecedented visibility into each property’s contents and condition lead to precision pricing. This will lead to better coverage and less underwriting losses.

Conclusion:

The traditional property appraisal process is ripe for disruption. By embracing AI and Machine Learning, insurers can achieve faster underwriting, reduce costs, and create a more efficient and customer-friendly experience.

Call to Action:

Are you ready to transform your high-value property insurance process? Contact us today to learn more about our innovative AI-powered solution.

.jpeg?width=1813&height=490&upsize=true&upscale=true&name=Artefact%201%20(9).jpeg)