Integrated Pre-bind and Post-bind Solution with Appian and Duck Creek

Case Study

Tender Management: A Leap Forward for a Global Engineering Leader.

Business Challenge

- Amidst the rapid pace of digital transformation, insurers face the daunting challenge of efficiently streamlining their submission processes.

- The influx of data from various sources, coupled with manual procedures, often results in delays, errors, and inefficiencies throughout the quoting and policy management stages.

Toolset/Technology/Platform/Accelerator Used:

- Appian &

- Duck Creek

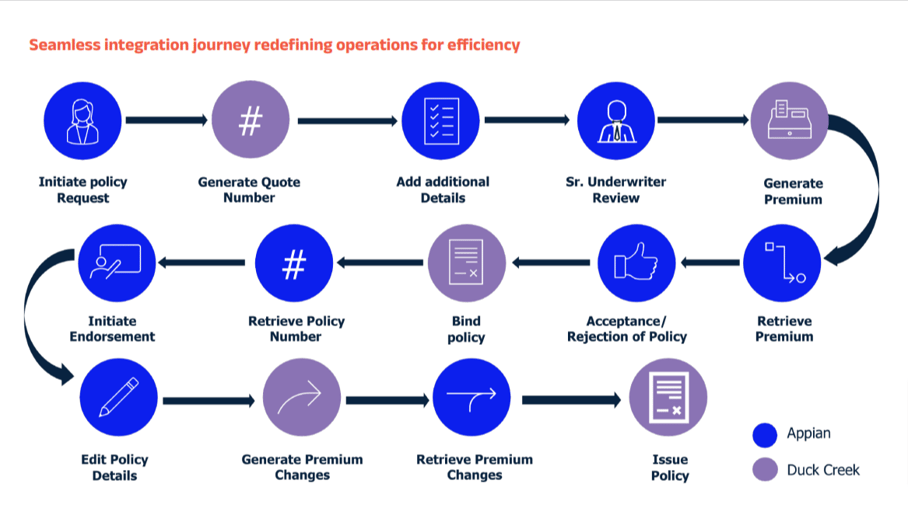

Seamless integration journey redefining operations for efficiency:-

- Increase Speed to Quote:Automate pre-bind and post-bind workflows, significantly reducing processing time and accelerating quote generation.

- Enhanced Risk Management: Leverage Appian’s robust risk management capabilities within the streamlined workflow, ensuring comprehensive risk assessment for informed decision-making.

- Improve Quote-to-Bind Workflow: Achieve a smooth and efficient process for both insurers and brokers by automating key steps between quoting and binding.

- Optimize Workflow and Case Management: Appian's workflow engine ensures efficient task assignment and tracking within the Duck Creek system, leading to improved efficiency, and streamlined case management

- Unify Data: Integrate data from various sources into a single platform, providing underwriters with a comprehensive view of each risk, facilitating a holistic underwriting process

- Adapt to the Changing Market: Appian's low-code platform empowers insurers to quickly build and deploy custom applications tailored to their specific needs, ensuring agility and the ability to adapt to market shifts.

- Effortless Integration: Pre-built connectors streamline the connection between Appian and Duck Creek, eliminating the need for complex manual integration and saving development time.

Benefits for Insurers:

- Improved Underwriting Efficiency: Streamlined workflows and automation lead to faster turnaround times and increased productivity.

- Reduced Operational Costs: Automation eliminates manual tasks and minimizes errors, leading to significant cost savings

- Enhanced Decision Making: Access to a centralized and unified data platform facilitates informed and accurate underwriting decisions

- Increased Customer Satisfaction: Faster quotes, improved communication, and a seamless experience contribute to enhanced customer satisfaction.

Benefits for developers:

- Connect to Duck Creek PAS: This integration is compatible with all cloud versions of Duck Creek.

- Save time with no-code integrations: Easily configure an integration using sorting, filtering pagination, and document support.

- Eliminate manual updates: Dynamically connect to the entire Duck Creek API schema. When a new endpoint is created or modified within your Duck Creek environment, your Appian connection can automatically update.

- Visually combine multiple API calls: Use the Appian Process Modeler to string multiple API calls together.

- Avoid complex API calls: Trigger a request by selecting from a list of operations instead of navigating complex API documentation.

WHAT WE DO

Explore our wide gamut of digital transformation capabilities and our work across industries

Explore