Bordereaux Processing Solution.

Case Study

Global Trade: The MyTrade Evolution.

Business Challenge

Operating delegated authority business can be complex when you are managing binder agreements and processing bordereaux submissions in various formats and degrees of data quality.

- Working with spreadsheets from different stakeholders in the distribution chain can be time-consuming, inefficient, and prone to human error.

- It can also cause difficulties in gaining a true reflection of risk exposure for informed decision making and regulatory reporting.

- When separate cover holders create bordereaux files for one carrier, the same data can end up presented in many different formats.

- There may be inconsistencies in how the data points themselves–date formats, addresses–are formatted, and even the various ordering of columns in tables can cause challenges and require time consuming manual intervention.

- Manually managing binder agreements and processing bordereaux files leads to a severe overhead for insurance companies leading to a cost of £ 25,000 – £30,000 annually for each FTE. In average there are errors in 10% of the cases. All these results in an overall expense of nearly £ 200,000/year.

Solution

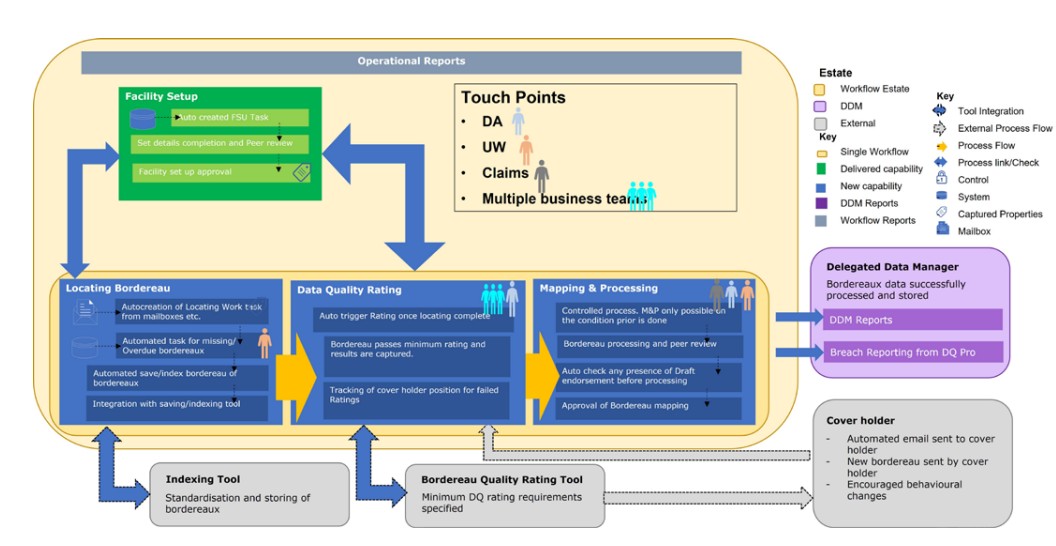

The Coforge Appian Bordereaux processing solution provides a cost-effective platform for efficient binder management and bordereaux processing supporting Cover holders, MGA’s, Data management team and Insurers in sharing information efficiently. Designed specifically for delegated authority business, the solution automates the processes involved in managing, transforming, consolidating, validating, and reporting bordereaux.

- Low code platform with configurable business rules and dynamic case management capabilities

- Simplified data collection and ingestion process

- Automated task assignment and referrals using business rules for facility creation and query handling

- Automated job to initiate bordereaux locating and business rules driven bordereaux quality check process

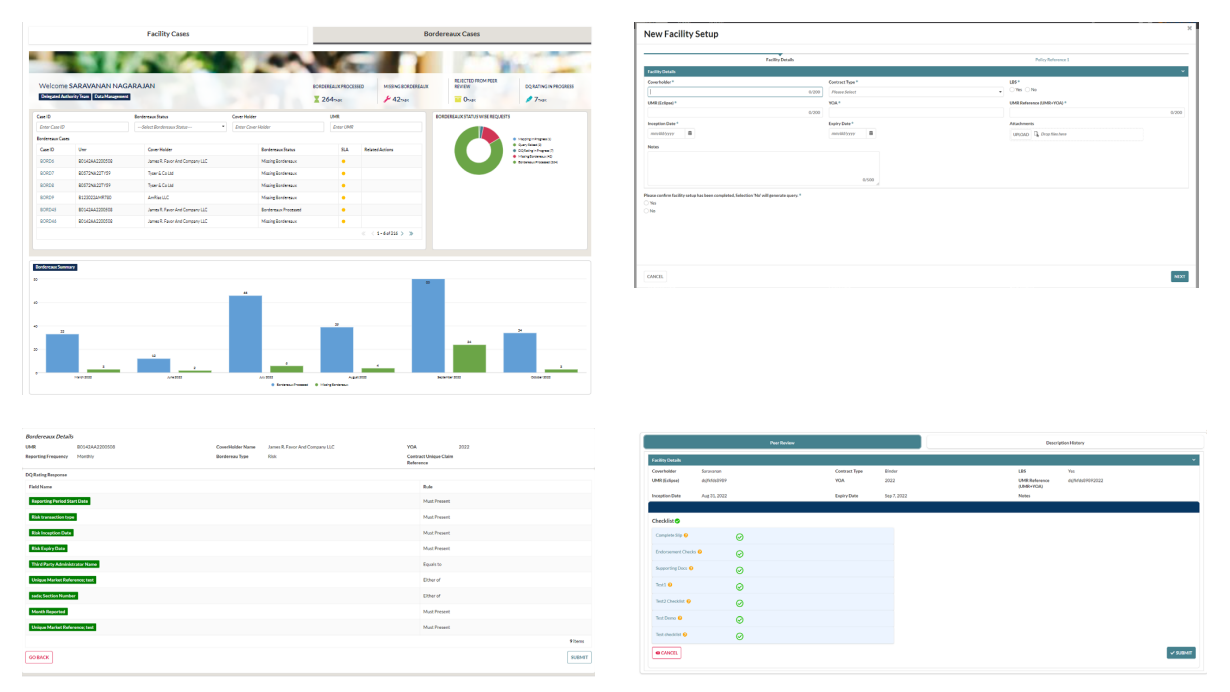

- Automated peer review process for facility creation and Bordereaux mapping process

- Intuitive and improved UI

Features

In the binder management lifecycle the solution provides:

- Automation mechanism in setting up incoming / outgoing binders.

- Recording contract details, uploading documents and providing MI and data visualisation dashboards.

- In the bordereaux processing component, the solution provides seamless processes for uploading incoming risk, claim and payment bordereaux from spreadsheet and mails.

- Supports mapping columns from source to target. Provides capability to map values to a standard list for consistency and easier reporting.

- With all data standardised to a common format, the solution saves time enabling the users to support increasing data sets. The solution provides MI and data visualisation based on bordereaux processing parameters like percentage processed, timing, number overdue etc

Benefits

- Enables overall reduction of ~20-30% manual effort and elimination of human errors

- Optimizes efforts around managing incoming bordereaux in multiple formats and producing out-going bordereaux in multiple formats for different parties.

- Provides bordereaux links to facilities and gives the ability to effectively respond to changes, additional data requirements with ease.

- Supports increasing data protection regulations with better data management and compliance features.

- Ensures data quality to business rules and supports Lloyds mandatory standards. Validation rules prevent payment and claims being processed with a corresponding risk.

- Reduces the chance of writing risk outside of binding agreements.

WHAT WE DO.

Explore our wide gamut of digital transformation capabilities and our work across industries.

Explore